Simple, smart, supported. Offer competitive retirement benefits without extra complexity or cost.

Retirement Benefits Without the Headache

Helping your team prepare for the future is an important part of attracting and keeping top talent. Yet designing and managing a 401(k) plan can be overwhelming, especially for small and mid-sized businesses. Complex rules, contribution limits, and ongoing compliance can take valuable time away from running your company.

401(k) Plans That Fit Your Business

Whether you’re launching your first plan or upgrading an existing one, CoAdvantage delivers customizable options and expert support to make retirement planning effortless.

Choose from Traditional, Safe Harbor, Roth and Profit‑Sharing 401(k) plans. We tailor employer contribution formulas, vesting schedules, and eligibility rules based on age, tenure, or hours worked, so your plan fits both your workforce and your budget.

Running a 401(k) doesn’t have to mean more paperwork. Our team handles plan setup and ongoing administration, weekly electronic contributions, compliance testing, and annual Form 5500 filings. We integrate your plan with payroll, tax, and benefits systems through the CoAdQuantum platform.

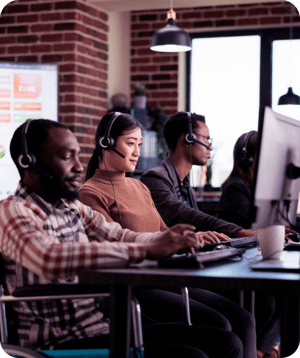

Empower your team with top‑tier investment options, retirement planning tools, and quarterly benefit statements. Employees can manage contributions and view balances from any device, and a dedicated support team answers questions and keeps them engaged.

Each year the IRS adjusts 401(k) contribution limits. We help maximize savings while ensuring your plan meets the latest regulations. Our experts guide you through contribution decisions and keep you compliant so you don’t have to worry about missing a change.

.png)

Stay Ready for the Unexpected

We’re more than a provider; we’re your co‑pilot in HR. Through our co‑employment model, we share employer responsibilities to deliver cost savings, reduce risk, and improve access to high‑value benefits like 401(k) plans.

CoAdvantage Blog

From guidance on payroll management and HR technology to tips on ACA compliance and wage reporting, explore our recent blog posts and stay ahead with insights that matter.

You Might Also Be Interested In...

Round out your HR strategy with these solutions

Benefits Administration

Streamline benefits enrollment and management with CoAdEnroll.Payroll

Services

Ensure accurate, compliant payroll processing..Risk Management & Compliance

Protect your business and your people.Employee Benefits & Insurance

Offer high‑quality health, dental, vision, and voluntary benefits.401(k) Frequently Asked Questions

A 401(k) is a tax‑advantaged retirement savings plan that allows employees to invest a portion of their paycheck before taxes into long‑term savings. It’s an effective tool for retirement preparation and a powerful way for employers to attract and retain talent.

We offer Traditional, Safe Harbor, Roth, and Profit‑Sharing 401(k) plans. Each plan can be tailored with different contribution formulas, vesting schedules, and eligibility rules to fit your workforce and business goals.

Employer contributions can be structured as Pro‑Rata, Integrated, New Comparability, or Safe Harbor. We’ll help you choose a formula that aligns with your budget and encourages employee participation.

We handle compliance testing, monitor IRS contribution limits, manage Form 5500 filings, and ensure your plan meets all regulatory requirements. Our experts keep you informed and your plan aligned with current laws.

Employees can log in via desktop or mobile to manage contributions, view balances, and access retirement education tools. They also receive quarterly statements and have access to a dedicated support team for questions.

Ready to Offer a Smarter 401(k)?

You don’t have to choose between simplicity and sophistication. With CoAdvantage you get both. Customizable plans, expert support, and the technology that makes your retirement program work are all part of the package. Let’s create a plan that works for your team and your bottom line.