Quick Summary

A Professional Employer Organization (PEO) helps small and mid-sized businesses simplify HR through a co-employment partnership that combines expertise, technology, and scale.

-

Handles payroll, benefits, compliance, and HR administration

-

Gives access to enterprise-level benefits and HR support

-

Reduces costs, risk, and administrative burden

-

Improves employee experience, retention, and payroll accuracy

-

Frees leadership to focus on growth, strategy, and people

Rather than replacing leadership, a PEO supports it. With an integrated HR model and ongoing guidance, businesses gain stability, flexibility, and a competitive edge, turning HR from a constraint into a catalyst for sustainable growth.

You Can't Make More Time, But You Can Choose More Life

Your roadmap to more life outside of work starts with smoother HR.

Time is the most valuable resource a business owner has. Once it's gone, you can't get it back. Between payroll deadlines, compliance concerns, hiring needs, and employee questions, HR responsibilities have a way of quietly filling every open space in your day.

You can't make more time.

But you can choose more life.

For many small and mid-sized businesses, that choice starts with partnering with a Professional Employer Organization (PEO). A PEO helps simplify HR, reduce administrative burden, and give business owners back the time and clarity they need to lead and grow.

What Is a PEO? (What Does PEO Stand For)

A Professional Employer Organization (PEO) provides comprehensive HR outsourcing services through a co-employment relationship.

In a PEO partnership:

- You retain control over your business operations, culture, and employees' daily work.

- The PEO shares employer responsibilities such as payroll processing, tax filing, benefits administration, and compliance support.

The key point: a PEO does not replace your leadership. It strengthens it by taking HR complexity off your plate.

Who PEOs Typically Serve

Professional Employer Organizations are most commonly used by small to mid-sized businesses that are growing faster than their internal HR infrastructure can support. According to the National Association of PEOs (NAPEO), half of PEO clients have between 10 and 49 employees and over a third (35%) have fewer than 10.

These employers, adding even just a few new members to their team, will face increasing complexity around payroll, benefits, compliance, and risk management. PEOs are especially valuable for such organizations that lack dedicated HR expertise but still need enterprise-level support, as well as for growing companies that want to stay focused on core operations without being pulled into the day-to-day demands of HR administration.

How PEOs Work for Small and Mid-Sized Businesses

Small and mid-sized businesses face a unique set of HR challenges. They’re large enough to feel the full weight of payroll, benefits, and compliance requirements, but rarely large enough to support deep in-house HR teams or negotiate enterprise-level benefits on their own. As a result, owners and leaders often find themselves pulled into HR administration at the expense of growth-focused work.

This is where PEOs are purpose-built to help. By moving routine employment responsibilities into a co-employment model, SMBs gain access to experienced HR professionals who support hiring decisions, employee management, and compliance best practices. That guidance helps reduce costly missteps while giving leaders confidence that they’re handling HR the right way.

The cumulative effect is leverage. Time, attention, and resources are freed up and reinvested back into the business itself. Leaders focus more on revenue, strategy, and innovation, supported by stronger HR infrastructure and a more stable workforce. For SMBs navigating growth with limited internal capacity, a PEO turns HR from a constraint into a competitive advantage.

How Does a PEO Work?

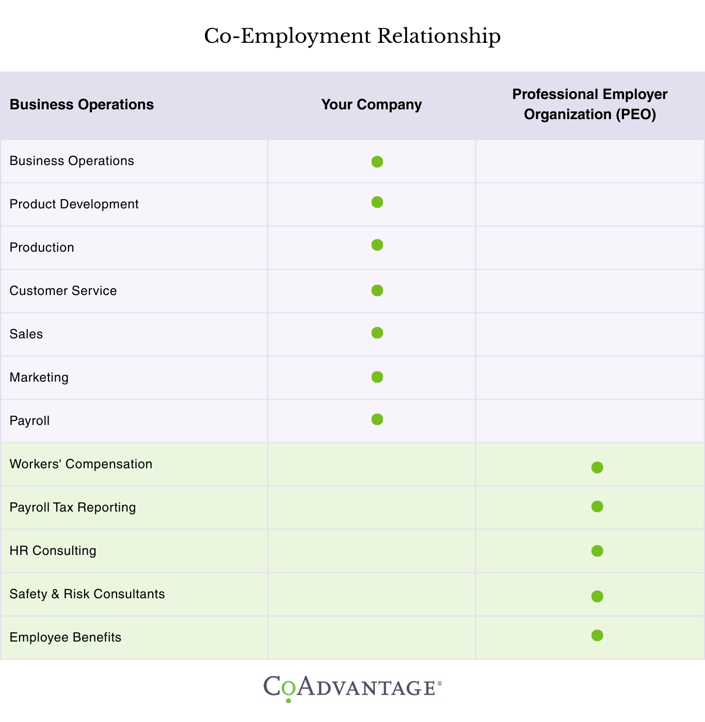

Co-Employment Relationship

At the core of a PEO arrangement is a co-employment relationship that clearly divides responsibilities between the employer and the PEO. The business retains full control over its workforce and day-to-day operations.

That includes hiring and firing decisions, setting compensation, managing schedules, directing work, and shaping company culture. In other words, the employees still report to the business, not the PEO.

The PEO, meanwhile, assumes responsibility for many of the administrative and compliance-heavy aspects of employment. This typically includes payroll processing, tax filings, benefits administration, workers’ compensation coverage, and guidance on employment laws and HR best practices.

By shifting these functions to a PEO, employers reduce administrative burden and compliance risk while maintaining complete authority over how their business operates and how their people are managed.

Explore a PEO partnership with CoAdvantage

PEO Services From Start to Finish: A Smoother HR Journey

Think of HR as a roadmap. From recruiting your first employee to supporting a growing workforce, every phase brings new responsibilities and complexity. Without the right support, those turns can slow you down. With a PEO like CoAdvantage, you don’t navigate that journey alone. You have a partner providing support at every turn.

What makes a PEO model different is not just the individual services offered, but how those services work together as an integrated system. Recruiting feeds onboarding. Onboarding connects to payroll and benefits. Benefits, training, and compliance reinforce retention and performance. Rather than a collection of disconnected tools or one-time implementations, a PEO delivers ongoing, coordinated support that evolves as your business grows.

Recruiting and Onboarding

Hiring the right people and setting them up for success should feel intentional and streamlined rather than ad hoc and overwhelming. A PEO helps streamline recruiting and onboarding so new hires feel supported from day one, without administrative bottlenecks or paperwork overload. In turn, improved onboarding boosts retention. Businesses with structured onboarding see employees that are 58% more likely to remain for three years. Given that turnover can cost as much as 33% of an employee’s annual salary, that saves money as well as workers.

PEOs help by supporting recruiting and onboarding with practical tools and expertise. That may include access to job posting platforms, applicant tracking systems, and performance management software that small businesses would otherwise struggle to implement.

The result is a more consistent hiring process, better candidate experiences, and smoother transitions from offer letter to fully productive employee.

Payroll and Timekeeping

Payroll is one of the most critical HR functions, and one of the easiest places for small errors to turn into big problems. A PEO manages payroll end to end, including wage calculations, tax withholding, filings, and regulatory compliance. This reduces the risk of errors that can lead to penalties, employee dissatisfaction, or legal exposure. It also removes a recurring administrative drain on business owners and managers who are already juggling multiple responsibilities.

There is a financial upside as well. Organizations that outsource payroll typically save around 18% on payroll-related costs. Payroll is often the clearest example of why outsourcing works: accuracy improves, compliance risk declines, and leaders regain time to focus on growing the business rather than processing paychecks.

Benefits Administration

Offering competitive benefits is one of the biggest challenges for small and mid-sized employers. Rising costs and administrative complexity often limit what businesses can provide, even when leaders know benefits are critical for attracting and retaining talent.

PEOs help level the playing field by giving small businesses access to enterprise-grade benefits through pooled purchasing power. This can include large group health plans, retirement options, employee assistance programs, and other benefits typically associated with much larger employers. Because these plans are negotiated at scale, businesses gain access to broader offerings at more manageable costs.

Administration is equally important. A PEO supports enrollment, compliance, and employee education, helping workers understand and use their benefits effectively. Employers that work with PEOs are significantly more likely to prioritize helping employees make informed benefits decisions, which directly affects satisfaction and retention.

Risk Management and Compliance

Employment compliance is not a one-time task. Laws and regulations change constantly at the federal, state, and local levels, and staying compliant requires ongoing attention. This is especially challenging for small businesses that lack dedicated compliance expertise.

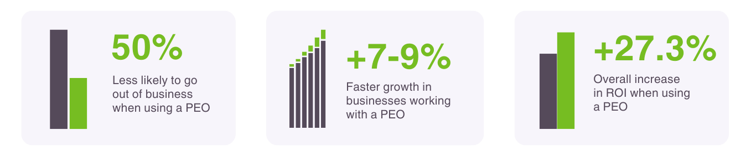

PEOs provide proactive risk management by monitoring regulatory changes, managing workers’ compensation, and offering guidance before issues escalate. According to National Association of Professional Employer Organizations, companies that work with a PEO are 50% less likely to fail when compared to non-PEO users, in part because compliance risks are addressed early rather than reactively.

The financial stakes are high. U.S. businesses spend an average of $10,000 per employee each year on compliance-related activities, costs that hit small employers especially hard. By handling workers’ compensation, unemployment insurance, and labor law compliance, a PEO reduces exposure to fines, claims, and unexpected liabilities.

Employee Training and Development

Training and development are often deprioritized in small businesses, not because leaders doubt their value, but because of time and resource constraints. Yet even modest investments in training can have measurable returns. “A 10 percent increase in training produced a 3 percent increase in productivity over two years,” said Iva Klepic, the Head of HR at the University of Mostar in Bosnia and Herzegovina, told the Society for Human Resource Management (SHRM).

PEOs help make training more accessible by offering or coordinating development programs that would otherwise be difficult to manage. This may include online learning libraries, compliance training, leadership development, or role-specific education. When training isn’t provided directly, PEOs often connect businesses with vetted third-party providers.

The outcome is a more capable, adaptable workforce that grows alongside the business. Over time, this investment supports higher performance, stronger engagement, and better readiness for change.

Ongoing HR Support and Expertise

HR challenges don’t arrive on a schedule. Employee relations issues, policy questions, and compliance concerns can surface at any time. With a PEO, employers gain ongoing access to experienced HR professionals who understand their business and provide guidance when it’s needed.

This continuous support helps shift HR from a reactive function to a strategic one. Instead of scrambling to solve problems after they arise, businesses can make more informed decisions around policies, organizational structure, and employee engagement. When HR practices align with broader business goals, HR becomes a value driver rather than a cost center.

Why Businesses Use a Professional Employer Organization?

For most employers, the decision to work with a PEO is driven by a broad need to simplify employment, reduce friction, and regain focus. As businesses grow, HR doesn’t just get bigger. It gets more complex, more regulated, and more time-consuming. A PEO exists to absorb that complexity so leaders and employees can concentrate on meaningful work.

Simplification of HR

A PEO brings payroll, benefits, compliance, and HR administration together under one coordinated system. For employers, that means fewer vendors, fewer handoffs, and fewer opportunities for things to fall through the cracks, not to mention a single point of contact for all HR concerns.

Time Gains

Business owners and leadership teams are often pulled deep into HR administration simply because no one else can manage it. Payroll deadlines, benefits questions, compliance updates, and employee issues quickly consume hours that should be spent on strategy, customers, and growth. By offloading administrative responsibility to a PEO, leaders reclaim that time without losing visibility or control.

Access to HR Expertise

A PEO provides ongoing access to experienced HR professionals who guide employers through decisions and ever-changing labor law requirements before problems arise, not after. That proactive support reduces risk and builds confidence at every stage of growth.

Reduced Administrative Burden

Through pooled buying power, businesses gain access to competitive, enterprise-grade benefits that help attract and retain talent. At the same time, payroll processing, tax administration, and compliance management become more efficient and predictable.

Business that partner with a PEO are:

The Employer Benefits of Partnering with a PEO

Reduced HR Costs

Outsourcing almost always comes down to cost reduction, and more often than not, it works. Deloitte’s 2023 Global Outsourcing survey found that 83% of organizations aimed to reduce costs through outsourcing in 2021, and within the next two years, 84% had achieved that goal.

For PEOs specifically, research from NAPEO shows that businesses using a PEO can save up to $1,775 per employee per year by reducing HR inefficiencies, minimizing compliance risks, and streamlining payroll and benefits administration.

The key here is quality of HR service. Advisory firm The Hackett Group has intensely studied the difference between world-class and average HR organizations and found that world-class (high quality) HR teams simply blow past others by every measure, including operating “at a 34% lower operating cost per employee than peers.”

By accessing top-tier, world-class HR through a PEO like CoAdvantage, even small to midsize firms can start to claim those cost efficiencies for themselves.

Consolidated Labor-Related Expenses

A PEO also simplifies budgeting by consolidating many labor-related expenses into a single, predictable line item. Payroll processing, benefits administration, workers’ compensation, and HR support are managed together rather than across multiple vendors.

This improves cost visibility, reduces surprise expenses, and makes workforce planning more predictable as the business grows.

Improved Employee Retention

Stronger HR infrastructure directly affects retention. Companies working with a PEO experience 12% lower employee turnover thanks to better onboarding, stronger benefits, and improved HR support. Similar research has shown turnover rates 10 to 14 points lower for PEO users compared to non-PEO employers. Lower turnover reduces recruiting costs, protects institutional knowledge, and stabilizes teams during periods of growth.

Access to Better Benefits

PEOs help small and mid-sized businesses offer competitive benefits by leveraging collective buying power. By pooling employees across many companies, PEOs can access large group health insurance plans at more favorable rates. This allows employers to offer comprehensive benefits without taking on the administrative burden of managing them alone.

Lower Risk and Fewer Compliance Issues

Businesses that partner with a PEO are significantly less likely to face compliance penalties, audits, or employment-related legal issues. Ongoing regulatory monitoring and expert guidance reduce exposure and help employers stay ahead of changing requirements.

Supporting Growth and Competitive Strength

By professionalizing HR, small businesses gain many of the competitive advantages typically reserved for larger organizations. They operate more efficiently, attract stronger talent, and focus leadership attention where it matters most.

Imagine a small shop with 40 employees trying to keep up with a giant corporation that has 400 or even 4,000 employees. In terms of HR, a PEO puts them on an even playing field. When a small business professionalizes its HR function by partnering with a PEO, it becomes more competitive.

See how CoAdvantage can support your business

The Employee Benefits of a PEO

Better and More Competitive Benefits

One of the most visible employee advantages of a PEO partnership is access to stronger benefits. Through pooled purchasing power, PEOs allow small and mid-sized businesses to offer benefits that typically mirror those of much larger employers. This often includes comprehensive health insurance options, retirement plans, and supplemental benefits that would otherwise be difficult or costly to provide.

For employees, better benefits are more than a perk. They are a signal of stability and long-term investment. Competitive benefits reduce financial stress, improve overall well-being, and play a major role in an employee’s decision to stay with an employer rather than look elsewhere.

Enhanced Employee Experience

A common misconception is that outsourcing HR leads to a colder, more distant employee experience. In practice, the opposite is often true. PEOs frequently provide higher-touch service, clearer processes, and more consistent communication than small businesses can manage on their own.

HR Support and Access to Resources

PEOs also expand employees’ access to HR expertise and self-service resources. Instead of relying on a single overextended HR generalist or business owner, employees can get timely answers to benefits questions, policy concerns, or workplace issues.

“Employees no longer need to turn to overworked HR departments to get a comprehensive understanding of what they’re signing up for,” Gary Stevens, front-end developer and founder of Hosting Canada, told Business.com about his experience with a PEO. “Instead, any questions employees may have can be turned directly to the PEO. Since one of their main functions is finding the best plans available, employees no longer need to worry that they’re making a mistake during their yearly enrollment.”

Payroll Accuracy and Reliability

Payroll issues quickly erode trust. In fact, over half (53%) say that repeated mistakes with payroll would lead them to start job hunting. Late or incorrect paychecks create frustration and anxiety, even when mistakes are unintentional. PEOs help ensure payroll is processed accurately and on time, with proper tax withholding and compliance built in.

Reliable payroll may seem basic, but it plays a foundational role in employee satisfaction. When employees trust that they will be paid correctly and consistently, it removes a major source of stress and allows them to focus on their work.

Taken together, these benefits create a noticeably better employee experience. By improving benefits access, service quality, HR support, and payroll reliability, PEOs help foster workplaces where employees feel supported, valued, and more likely to stay for the long term.

Spend less time on HR. Choose more life with CoAdvantage.

How a PEO Compares to Other Models

When businesses begin exploring HR outsourcing, a PEO is often one of several options under consideration. Administrative Services Organizations (ASOs), Employers of Record (EORs), and traditional HR outsourcing models all address parts of the HR challenge, but they differ significantly in structure, responsibility, and long-term fit. Understanding these differences helps employers choose the right model for their goals.

PEO vs ASO

A PEO and an ASO may appear similar on the surface, but the underlying relationship is very different. A PEO operates under a co-employment model, meaning certain employer responsibilities, such as payroll tax administration and workers’ compensation, are shared. This allows the PEO to deliver deeper compliance support, broader benefits access, and more integrated HR services.

An ASO, by contrast, provides administrative support only. The business remains the sole employer of record and retains full legal responsibility for compliance, taxes, and risk. ASOs can be useful for companies that want software and basic administrative help but already have strong internal HR expertise. For businesses seeking risk mitigation and ongoing guidance, a PEO typically offers more comprehensive support.

PEO vs EOR

An Employer of Record is designed primarily for hiring employees in locations where a business does not have a legal entity, often internationally. In an EOR arrangement, the EOR becomes the legal employer, handling employment compliance entirely while the business directs day-to-day work.

PEOs, on the other hand, are built for ongoing operations within a company’s existing legal structure, typically in the United States. Employees remain part of the business, and the employer maintains control over workforce decisions. While EORs work well for rapid global expansion or short-term market entry, PEOs are better suited for long-term growth, workforce stability, and integrated HR management.

PEO vs Traditional HR Outsourcing

Traditional HR outsourcing usually involves piecemeal services such as payroll processing or benefits administration delivered by separate vendors. These arrangements often lack integration and strategic support, requiring employers to coordinate multiple providers.

A PEO consolidates these functions into a single, coordinated model that combines technology, expertise, and accountability. Rather than managing HR in fragments, businesses gain an ongoing partnership that evolves as their needs change.

How to Know When It's Time to Outsource HR

Outsourcing HR to a PEO isn’t about hitting a specific employee count. It’s about readiness. As businesses grow and evolve, HR demands often increase faster than internal capacity. The following signs can help determine whether a PEO partnership would deliver meaningful value for your organization.

Your Business Has Reached the "Sweet Spot" Size

Most businesses find the greatest return from a PEO when they are large enough to feel HR strain but not large enough to justify a full internal HR department. That’s why so many small businesses start turning to PEOs, even with only a dozen or so workers. That said, the key factor isn’t headcount alone. It’s the point at which payroll, benefits, and compliance demands begin to outpace internal resources and leadership attention.

You Lack In-House HR Capacity

In many growing businesses, HR responsibilities fall to owners, finance leaders, or already-stretched managers. Over time, this creates an impossible tradeoff: either HR work suffers, or revenue-generating work does.

Even organizations with HR staff can reach this breaking point. Research from Society for Human Resource Management shows that nearly three-quarters of HR professionals feel overstretched, with limited time and staffing cited as major barriers to success. When capacity gaps start affecting performance, outsourcing becomes a practical solution.

Your HR Operation Isn't Scalable

Ask a simple question: if your employee count stayed the same but complexity increased, would your HR operation hold up? New regulations, multi-state payroll, remote work, or more sophisticated benefits can strain systems that once worked fine. If HR processes don’t scale with complexity, risk and inefficiency tend to follow.

You're Struggling to Meet HR-Related Goals

Persistent challenges like high turnover, payroll errors, compliance issues, or slow hiring are often signs that HR lacks the focus or expertise it needs. A PEO brings specialized support that helps address these issues directly, improving consistency and outcomes over time.

Your Business Is Growing or Expanding

Growth introduces HR complexity whether you’re opening new locations, entering new markets, or acquiring another business. Navigating new employment laws, integrating teams, and aligning policies requires expertise and flexibility that a PEO is designed to provide.

You Want Better Results from HR

As businesses mature, HR must evolve from a transactional function into a strategic one. A PEO can help shift HR from reactive problem-solving to proactive workforce planning that supports business goals. This is where accessing best-in-class HR services from a PEO can start making a tangible difference.

Consider The Hackett Group’s research into world-class HR. They found that world-class HR organizations “achieve 14% more internal placements per 1,000 employees than their peers.” This means high-performing HR operations are significantly more efficient at a core HR duty and producing better bottom-line results.

You Want a Competitive Advantage

Finally, if attracting and retaining talent feels harder than it should, a PEO can help level the playing field. Stronger benefits, better onboarding, and consistent HR support all contribute to a more compelling employee experience and a stronger competitive position.

Transitioning into a PEO Relationship

For employers considering a PEO, one of the most common questions is simple: what happens next?

1. Build a Dedicated Transition Team

While the PEO will guide the process, the employer plays a critical role in managing the transition internally. Creating a small, dedicated transition team ensures accountability and coordination on your side. This team acts as the central point of contact, helping manage timelines, gather data, and align internal stakeholders. Their involvement keeps the process moving smoothly and prevents key details from being overlooked.

2. Develop a Clear Transition Plan with Your PEO

A detailed transition plan sets expectations early. In most cases, the PEO takes the lead in designing the plan, outlining timelines, responsibilities, and milestones. This includes formally transferring payroll responsibilities, integrating HR technology, securely migrating employee data, and scheduling training. A clear plan reduces uncertainty and ensures every HR function is addressed during the handoff.

3. Coordinate Closely and Establish a Strong Working Relationship Early

The transition period is also the beginning of a long-term partnership. Early coordination helps both teams understand how they’ll work together day to day. Introducing internal leaders to the PEO’s service team, sharing company culture and priorities, and aligning on communication styles builds trust.

4. Minimize Disruptions and Support Employees Through the Change

For employees, transitions can create anxiety if not handled carefully. Maintaining uninterrupted payroll, benefits access, and HR support is essential. Clear guidance, timely training on new self-service tools, and reassurance about benefits continuity help employees stay focused on their work rather than worrying about changes behind the scenes.

5. Maintain Open Communication with All Stakeholders

Communication is the single biggest factor in a smooth transition. Employers should proactively share updates, timelines, and expectations with employees and leadership while maintaining regular check-ins with the PEO. Questions, concerns, and feedback should be addressed early before they become friction points.

6. Document Processes and Keep Thorough Records

Finally, thorough documentation keeps everyone aligned. Recording agreements, workflows, and transition steps ensures clarity and continuity. Well-documented processes reduce confusion during the transition and provide a reference point as the partnership evolves.

Your Roadmap to More Life Starts with the Right HR Partner

Ultimately, when HR is handled efficiently and proactively, something powerful happens. Your workday gets lighter. Your focus sharpens. And the time once spent managing payroll, compliance, and benefits can go back where it belongs: growing your business, supporting your people, and living your life outside of work.

At CoAdvantage, we partner with businesses across the entire employee lifecycle. From recruiting and onboarding to payroll, benefits, and compliance, our end-to-end HR support helps remove roadblocks and keep your business moving. With the right HR partner, you don’t just manage work better. You create more room for what comes next.

Request a Free Consultation

Still navigating payroll, compliance, and HR responsibilities on your own? If you're exploring what a PEO is and whether it's right for your business, we're here to help.FAQs About Professional Employer Organizations (PEO)

Who is the employer when using a PEO?

In a PEO relationship, employment is shared through co-employment. Your business remains the employer for day-to-day operations, hiring decisions, compensation, and performance management. The PEO becomes the employer of record for specific administrative purposes such as payroll processing, tax filings, and benefits administration.

How does a PEO affect my employees?

From an employee’s perspective, the employment relationship stays largely the same. What changes is access to better benefits, more consistent HR support, and reliable payroll and compliance processes. Employees typically gain improved self-service tools and clearer access to HR resources.

Do PEOs work for multi-state employers?

Yes. In fact, PEOs are especially valuable for multi-state employers because they help manage differing state employment laws, payroll tax requirements, and compliance obligations. This simplifies expansion and reduces risk as businesses grow across state lines.

Is a PEO the same as HR outsourcing (HRO)?

Not exactly. Traditional HR outsourcing typically provides fragmented services without shared employer responsibility. A PEO delivers integrated HR support through a co-employment model, combining technology, expertise, and accountability into a single partnership.

.png?width=663&height=347&name=Copy%20of%20CoAd_Case%20Study%20Quote%20Card%202%20(1).png)