%201.png?width=300&name=CoAd_Hero_payroll%20(1)%201.png)

Your partner for payroll: smart technology and real people working together to make payroll effortless.

%201.png?width=300&name=CoAd_Hero_payroll%20(1)%201.png)

Payroll Should Not Hold You Back

Running payroll involves far more than cutting checks. Tracking hours, juggling tax laws, and meeting deadlines pulls your attention away from growth. The stakes are high and the time it takes add up fast.

What's Included in Our Payroll Services

With CoAdvantage, payroll is more than just numbers. It's about a commitment to the people you're paying: to get it right and ensure it's accurate, compliant, and built for your business.

We handle end-to-end payroll processing and check printing, support full wage and hour compliance, and provide detailed job costing along with general ledger reporting. You also get custom payroll reporting and complete federal, state, and local tax filings—all built to keep your payroll accurate, compliant, and aligned with your business needs.

We simplify employee management by supporting new hire onboarding, handling address and personal information updates, and managing direct deposit setup. Our services also include tracking pay rate changes and history, ensuring W-4 and state-specific tax form compliance, monitoring PTO and time-off accruals, providing employment and wage verification, and administering I-9 and E-Verify requirements.

Through our Earned Wage Access solution Powered by Immediate, employees can access their earned wages at little to no cost to them and with no cost to employers.

We manage benefits enrollment, deductions, and ongoing maintenance while supporting credit-back deductions for in-house benefit plans. Our team handles garnishment and wage deduction processing, provides certified and OCIP payroll reporting, and delivers custom Excel-based reports. We also ensure seamless time clock integration and compatibility with time import systems to keep your payroll accurate and efficient.

We support multi-state payroll and compliance by handling tax withholding, deposits, and filings across jurisdictions. Our team manages year-end forms, including W-2s, W-3s, 940s, and 941s, ensuring timely and accurate submissions. You’ll also receive customized reports that provide the insights you need to stay informed and in control.

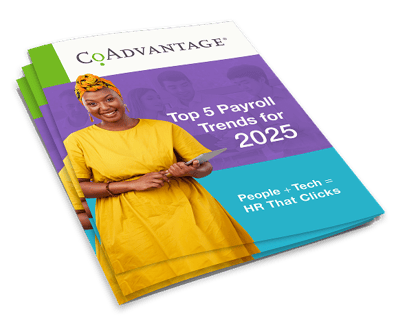

Get Ahead of What's Next

Today’s payroll landscape is evolving fast. Stay ahead of the curve with our free guide: Top 5 Payroll Trends for 2025. Discover how technology, compliance updates, and workforce shifts are reshaping payroll and what your business can do now to prepare.

More Payroll Resources

Browse insights, tips, stories and best practices on how to manage payroll for businesses like yours.

No Tax on Overtime Explained: What It Means, What Qualifies, and Real-World Examples

Is Remote Work Going Away? What Employers Should Know

4 Reasons Why HR Should Report to the CEO

Read MoreWhat Happens If Employers Violate Labor Laws?

The One Big Beautiful Bill Act: Employer FAQs

Handling Unprofessional Behavior in the Workplace: A Manager’s Guide

How Much Time Do Employees Really Work?

The 3 R’s of Business Etiquette: Respect, Restraint, and Responsibility

Hiring Across State Lines? Here’s What Employers Need to Know About Multi-State Compliance

No Tax on Tips Explained: Real-World Examples by Industry

You Might Also Be Interested In...

Explore other CoAdvantage solutions that work alongside payroll:

Benefits Administration

Simplify enrollment and manage ongoing benefits with ease.Human Resources

Support

Get help with onboarding, training, and employee relations.Risk & Compliance

Management

Stay up‑to‑date on labor laws and minimize liability.Time & Attendance Management

Simplify scheduling and time‑tracking with integrated tools.Your Questions About Payroll, Answered

It’s handing off time-consuming payroll tasks, like wage calculations, tax filings, and payments, to a trusted provider who does it accurately and on time.

You provide the hours, pay rates, and employee details. CoAdvantage handles determining calculations, pay delivery, tax filings, and compliance reporting. You keep full visibility through our secure platform.

If payroll is slowing you down or taking time away from running your business, it’s time to outsource. By partnering with a professional employer organization like CoAdvantage, you simplify your back office, reduce administrative burden, support compliance, and improve accuracy while giving you access to tools and talent typically reserved for larger companies.

It’s a smart, cost-effective way to stay focused on growth, not paperwork.

Key Functions of Outsourced Payroll

- Automate time tracking and wage calculations

- Ensure accurate payroll processing and secure delivery

- Navigate multi-state payroll and tax compliance

- Payroll tax withholding, deposits, and filings

- Manage employee deductions and garnishments

- Handle year-end tax form processing (W-2s, W-3s, 940s, 941s)

- Customized payroll and job costing reports to match the way you work

- Integrate with time clocks, attendance systems, and an integrated time and labor management (TLM) system.

Making sure payroll adheres to all applicable federal, state, and local laws related to employee compensation, tax filings, and labor regulations. This includes correct wage calculations, timely tax payments, proper documentation, and staying updated on legal changes. CoAdvantage ensures that you stay ahead of the changing regulations.

Automate the busywork. Stay organized. Get expert support. Outsourcing gives you the freedom to focus on growth without missing a beat.

Less Time on Payroll. More Time on Growth.

Payroll, HR, and compliance can take over your day. With CoAdvantage, you keep control without doing it all yourself. CoAdvantage experts handle the complexities so you don’t have to. Reduce risk, and ensure your team gets paid right, every time. Whether you're managing one location or scaling across the nation, CoAdvantage grows with you.