From payroll and benefits to compliance and risk management, CoAdvantage delivers scalable HR solutions tailored to help grow your business.

Simple, Streamlined, Effective

As a full-service professional employer organization (PEO), CoAdvantage provides integrated HR solutions for:

Payroll Management

Accurate and scalable processing of employee wages, taxes, and deductionsEmployee Benefits

Affordable access to Fortune 500-style health, dental, vision, and retirement plansRisk and Compliance

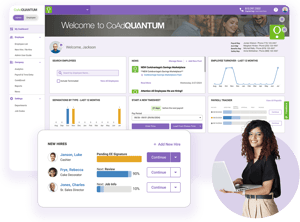

Proactive risk mitigation and support for federal, state, and local compliance regulations, including FMLA and workplace safetyHR Technology

Secure, all-in-one HCM platform to manage time tracking, employee data, and onboarding workflowsWhy CoAdvantage?

Growing businesses face complex HR challenges—from navigating regulations to managing employee relations. We simplify these processes, giving you expert support and seamless solutions that evolve with your business.

.png)

A seasoned partner that understands HR inside out and frees you from the administrative burdens and complexity that come with managing HR in-house.

Attract and retain top talent and gain a competitive advantage with pooled buying power, reliable guidance, and robust benefits packages that are often accessible only to larger businesses.

Work with a team that learns your business and stands beside you. From everyday HR tasks to sensitive employee issues, we provide clear guidance, helpful templates, and fast follow-through. You get a steady partner who helps you solve problems, reduce risk, and keep work moving.

Provide managers and employees with a secure, intuitive platform designed to simplify HR management, streamline operations, and enhance workplace productivity.

No matter the size or stage of your business, our efficient HR infrastructure and scalable services grow with you so you can focus on your business and its goals.

IS A PEO RIGHT FOR YOU?

See if HR outsourcing will benefit your business.What Our Clients Say

Request a Free Consultation

CoAdvantage Blog

From guidance on payroll management and HR technology to tips on ACA compliance and wage reporting, explore our recent blog posts and stay ahead with insights that matter.